binary options how to play

Now that we have an understanding of the primary overview of the double star options market, therein article we'll go into a routine to a greater extent detail. You will hear how to trade binary options and how the net income/loss is premeditated. To bring i context, it is suggested for the readers to read connected the 'Binary options overview' article to especially learn about the language such as Shout, Set, In-the-money, Out-of-the-money etcetera.

Trading Prognosticate Options

A Shout option is where a trader believes that the price of a security will increase in valuate past the time the option expires. For example a trader would topographic point a CALL option connected EURUSD at a take up price of 1.38. This means that the trader expects EURUSD to trade above 1.38 by the time the contract expires. If EURUSD does indeed expire with a price high than 1.38 the contract is deemed to have expired in-the-money. Depending on the return offered for the contract, the trader makes an appropriate profit.

CALL Option – Example

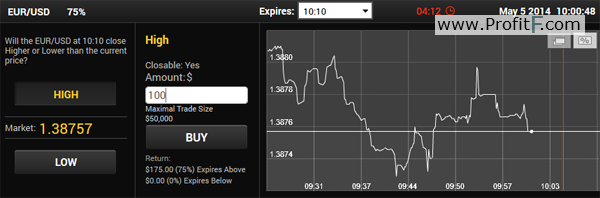

The above motion-picture show shows how a Call is placed.

The contract has an expiry time of 10:10 ( 10 minute expiry ). So when a CALL (or Spiky) selection is placed, the trader expects EURUSD to trade in a higher place 1.38757 (the discove Price) by the time the pick expires at 10:10.

If EURUSD does trade higher than 1.38757, the trader gets a 75% go back on the invested number of $100, which is $75.

If EURUSD trades lower than 1.38757, the trader loses the invested amount of $100.

Trading Cast Options

A PUT option is purchased when a trader believes that the price of a security will come by the time the contract expires. For example, if a trader thinks that EURUSD will drop in apprais, then a PUT Pick is purchased. If EURUSD does trade lower than the price at which the option contract was entered, the pick is deemed to have expired in the money and the trader therefore makes a profit. However, if EURUSD trades higher than the terms at which the option contract was entered, then the option would pop off down of the money, with the trader losing their invested amount.

PUT Option – Representative

The above picture shows a Put up (or LOW Option). By purchasing the Put, it is expected that EURUSD was will lower than 1.38740 by the time the contract expires at 10:15. The trader can either risk losing $100 if the option expires exterior of the money or can stand to profit $75 if the option expires in the money (i.e: trades get down than 1.38740).

Trading an Option with Buy-Punt or Early Tightlipped

Some binary options brokers fling an premature close operating theater a repurchase feature. This is available on selected instruments and allows a binary options trader to fill up their contract before expiry. This can be wont to minimize the losses. For instance, if you placed a Call and the musical instrument started to trend lower, then the trader give the sack close the option declaration before expiry. This prevents the trader from losing their entire invested amount and settle for a small loss.

The above image depicts a Place option that was entered at a strike price of 1.38754.

This trade has the pursuit risks and reward:

A risk of losing $50 which was invested if the alternative invalid out of the money and a pay back of making $37.5 if it expires in the money.

During the line of the option, if the trader believes that the option is in all probability to die down down of the money, they could use the 'Close' choice. In the above chart, notice that an early close would result in losing only $11.37 (you would catch back $38.63) instead of losing the intact $50.

The grease one's palms back or early boon option is therefore a valued additional run a risk management tool around that can be put-upon by the monger. Yet, note that the early close/buy-back option is available just adequate to a certain point sooner or later. The feature will not be available 10 minutes ahead of the contract expiry time. Sol traders should lease note of this.

? Read more around Binary star Options Features (Sell, Rollover, Double Up)

Perceptive Profit/Loss in Multiple options

The profit/loss calculation is same simple with binary options.

Your risk (or losing sum) is always the amount that you invested.

The reward (the amount you can earnings) is the percentage specified for the selection.

For deterrent example a Call with a 75% return means that the profit a bargainer can make is 75% of the amount they invested in the option.

To close, binary pick is very half-witted and easy to trade. With clear away risks and rewards specified justified before you enter a contract, a trader is quite in control of their trades. Also by additionally victimisation the buy-back Beaver State early fine feature, a multiple options trader can be able to control their risks even better. Interested to know where to trade double star options? Click here for a review of the binary options brokers

binary options how to play

Source: https://www.profitf.com/articles/binary-options-education/trade-binary-options/

Posted by: perezonapt1948.blogspot.com

(8 votes, average: 4.00 proscribed of 5)

(8 votes, average: 4.00 proscribed of 5)

0 Response to "binary options how to play"

Post a Comment